ETH Price Prediction: Will Ethereum Reclaim $3,000 Amid Institutional Headwinds?

#ETH

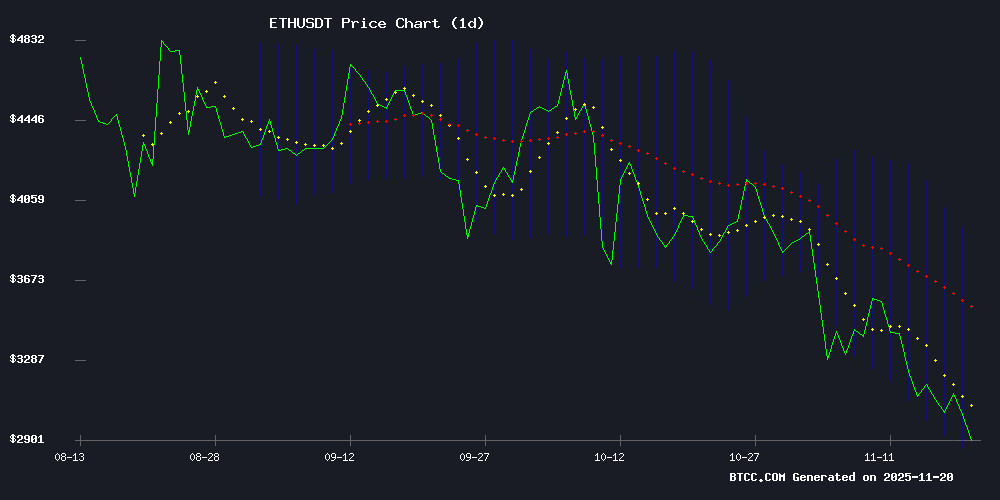

- ETH trades at $2,978.70, testing crucial technical support levels below the 20-day moving average

- Institutional outflows and Vitalik Buterin's risk warnings create fundamental headwinds for price appreciation

- The $2,830-$2,980 support zone must hold for any near-term attempt at reclaiming the $3,000 psychological level

ETH Price Prediction

ETH Technical Analysis: Critical Support Test Ahead

Ethereum is currently trading at $2,978.70, testing crucial technical levels according to BTCC financial analyst John. The price sits below the 20-day moving average of $3,349.93, indicating short-term bearish momentum. The MACD reading of -36.46 shows weakening momentum, while Bollinger Band positioning between $2,831.36 and $3,868.49 suggests the asset is in a consolidation phase.

John notes that holding above the $2,830 support level could pave the way for a retest of the $3,000 psychological barrier. However, breaking below this support might trigger further declines toward $2,700.

Market Sentiment: Institutional Pressure Meets Technical Support

Current market sentiment reflects a battle between institutional outflows and technical support levels, says BTCC financial analyst John. Recent headlines highlight ethereum reserve companies triggering sell-offs amid market weakness, while simultaneously approaching liquidity reset zones that could signal potential rebounds.

John emphasizes that Vitalik Buterin's warnings about existential risks and BlackRock's growing influence create fundamental headwinds, but the technical setup suggests the $2,830-$2,980 zone represents critical support that must hold for any near-term recovery.

Factors Influencing ETH's Price

Ethereum Reserve Companies Trigger Sell-Off Amid Market Weakness

Ethereum reserve companies, once steady accumulators of ETH, have shifted to aggressive selling. FG Nexus liquidated 10,922 ETH for share buybacks, reducing its holdings to 40,005 tokens. This contraction reflects mounting pressure to maintain share value as ETH's underperformance threatens mNAV thresholds.

The sell-off echoes broader institutional unease. ETHZilla's earlier divestment set a precedent—when mNAV falls below 1, companies must sacrifice holdings to stabilize equity. Newer entrants lack the buffer of long-term borrowings that shielded pioneers during past downturns.

Market observers note a paradox: these sales occur despite Ethereum's fundamental strengths. The moves reveal how short-term price action can override strategic accumulation plans, even among sophisticated holders.

Ethereum Nears Liquidity Reset Zone, Signaling Potential Rebound

Ethereum trades near $3,019—a liquidity reset level that historically precedes market reversals. The descending wedge pattern and stable Money Flow Index (MFI) suggest an impending breakout.

Market depth is thinning, mirroring past cycles where sharp liquidity drops preceded aggressive recoveries. Analysts watch for confirmation of a rebound as institutional interest builds.

Key technical indicators align with 2023's Q1 rally structure, when ETH surged 45% post-liquidity reset. Current price action echoes this pattern, though volatility remains elevated.

Structural and Liquidity Risks Challenge Tom Lee's $20B Ethereum Bet for BitMine

BitMine's Tom Lee is aggressively expanding his Ethereum treasury position, committing billions to the strategy. Yet mounting risks—liquidity constraints, valuation pressures, and structural market vulnerabilities—threaten to undermine the bold wager.

Ethereum's recent volatility exacerbates concerns. While Lee remains bullish, the sustainability of such a concentrated bet faces scrutiny as macro conditions tighten and crypto markets mature.

Ethereum Must Hold Key Support to Target $3,300 Amid Institutional Outflows

Ethereum faces a critical juncture as it struggles to maintain support above $3,020, a level that could determine its near-term trajectory. The second-largest cryptocurrency by market cap dipped 0.9% in the past 24 hours, reflecting persistent selling pressure.

Market observers note that sustained institutional outflows are creating headwinds for ETH's recovery. The asset must defend current levels to preserve bullish technical structure and enable a potential rally toward the $3,300 resistance zone.

Vitalik Buterin Warns of Ethereum's Existential Risks Amid BlackRock's Growing Influence

Ethereum co-founder Vitalik Buterin has issued a stark warning about the blockchain's future, cautioning that institutional dominance—particularly from Wall Street giants like BlackRock—could undermine the network's foundational principles. Speaking at the Funding the Commons event during Devconnect in Buenos Aires, Buterin highlighted two critical risks: the potential crowding out of decentralization-focused developers and pressure to adopt technical changes favoring institutional stakeholders.

"How do you avoid capture by big behemoths like BlackRock?" asked Tor Project co-founder Roger Dingledine, prompting Buterin's candid response. He emphasized that rapid ETF-driven ETH accumulation by institutions might push protocol adjustments—such as 150ms block times—that erode permissionless participation. "The community must safeguard censorship resistance and open access," Buterin asserted, framing the challenge as a battle for Ethereum's soul.

Will ETH Price Hit 3000?

Based on current technical indicators and market sentiment, ETH faces significant resistance near the $3,000 level. The current price of $2,978.70 sits just below this psychological barrier, with several factors influencing the potential breakthrough.

| Factor | Current Status | Impact on $3,000 Target |

|---|---|---|

| Technical Position | Below 20-day MA ($3,349.93) | Negative |

| MACD Momentum | -36.46 (Bearish) | Negative |

| Bollinger Band Position | Lower Half | Neutral |

| Institutional Flows | Net Outflows | Negative |

| Key Support | $2,830-2,980 Zone | Critical |

BTCC financial analyst John suggests that while immediate breakthrough appears challenging, holding current support levels could enable a gradual move toward $3,000 over the coming weeks, provided institutional selling pressure subsides.